“Musk paid the most at 3.27 percent between 2014 and 2018, while Warren Buffett paid the least at just 0.1 percent. In one year, Jeff Bezos made so little traditional income that he claimed and received the Child Tax Credit”

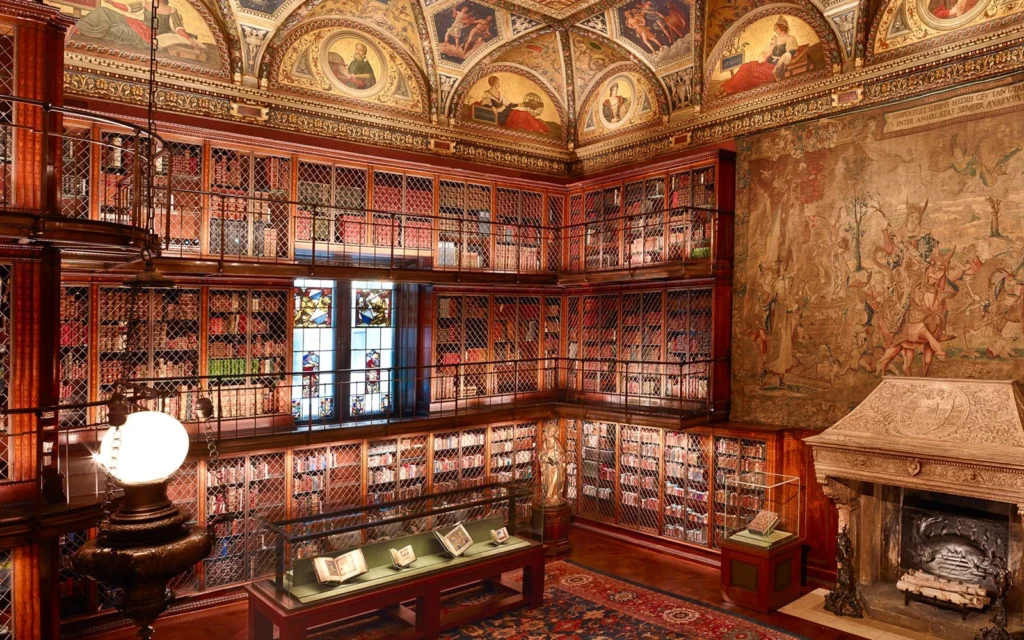

No one should have more than $100 million, full stop. And remember the Gilded Age, when the ultrarich (pre income tax) had morals enough to leave lasting legacies, like the Getty Museum or Carnegie Hall or the Morgan Library? (Who wouldn’t want to spend a year sitting in that library?)

The Morgan Library & Museum

https://prospect.org/power/2025-03-25-existential-threat-ultra-billionaires-elon-musk/

The Existential Threat of Ultra-Billionaires

A handful of rich guys will burn human society to the ground rather than pay a dime in tax.

March 25, 2025

Pool via AP

Elon Musk listens during a cabinet meeting with President Donald Trump in the White House, March 24, 2025, in Washington.

Elon Musk has long boasted that he is a climate hero. By selling electric vehicles, he claimed to inaugurate a future of zero-carbon transportation. “The fundamental intention of Tesla, at least my motivation, was to accelerate the advent of sustainable energy,” he once said.

The climate benefits of EVs can be overstated. They are certainly better for the climate than gas-powered cars, but they require a lot of emissions to produce, and there are still secondary emissions from the electricity needed to charge them, depending on where you live.

But whatever climate bona fides Musk had previously established are now going directly out the window. Musk, as shadow president in the Trump administration, is overseeing the utter devastation of Joe Biden’s ambitious climate program. As Heatmap News has covered in detail, solar and especially wind are slumping as Trump threatens to slash federal subsidies. Republicans are likely to gut at least some of the Inflation Reduction Act (Biden’s marquee climate law) to make budget headroom for tax cuts for the rich. Federal funding for EV chargers has been slashed, and even existing chargers are being torn out at federal buildings.

Why? Certainly some of it comes down to Musk melting his brain into a fine slurry interacting with his neo-Nazi pals on Twitter/X. And there’s a ruthless economic calculus here: Because Tesla is far ahead of its counterparts on electric vehicles (or at least was), it can give up subsidies, which will have the effect of crippling its competition.

But there is also a concrete reason: Kamala Harris’s proposed tax on billionaires.

Political scientist Adam Bonica provides a convincing argument along these lines. Musk’s behavior is even more curious when you take into account how much better Democratic administrations are for billionaires than Republican ones over the last 40 years. The reason is Democrats have presided over growing economies, which boost the stock market, while Republican ones—because they always, always screw everything up—typically lead to recessions if not financial crises.

But Harris, for the first time in decades in a presidential campaign, proposed doing something about soaring wealth inequality: a 25 percent tax on “unrealized gains” over $100 million. This is a reference to how billionaires have rigged the system to pay almost nothing in taxes. They take nominal salaries, or none at all, and instead receive their compensation as packages of stock and options. So long as you don’t actually sell these assets, you never have to pay the capital gains tax.

“They borrow against their assets, deduct the interest payments, and live lavishly without ever realizing taxable income,” Bonica writes. And when they die, they avoid the estate tax through the “stepped-up basis” loophole, which allows their heirs to start the capital gains tax counter from zero, starting the whole process over again. Presto: a self-perpetuating oligarchy.

Facing a threat to their wealth, billionaires mobilized to an unprecedented degree. As Bonica outlines, back in 2008, donations over $10 million made up just 4 percent of contributions for Republican campaigns. But in 2024, they made up fully 56 percent—and of a much larger pie. Those mega-donors paid just $58 million in 2008, but last year they paid $2.472 billion, almost two and a half times what they spent in 2020. Elon Musk by himself accounted for more than a tenth of that money, and much more than that if you include his purchase of Twitter as a political act. Without this money, Trump likely would not have won.

The hysteria of this reaction should be emphasized. Had she won, Harris’s billionaire tax plan almost certainly would not have become law. The more easily bribed fraction of her own party’s caucus, amounting to maybe a quarter of representatives and senators, would be dead set against it. (Witness the appalling spectacle of Senate Democrats shilling for the crime-ridden crypto industry.) If that somehow failed, the reactionary Supreme Court majority, in between ultra-luxurious vacations funded by their billionaire pals, could be expected to declare it unconstitutional.

A savvy billionaire, in other words, would have dismissed Harris’s plan as unrealistic, and supported her against her criminal madman opponent. A few like Mark Cuban did so (though he also threatened to turn against Harris should her idea become law). Even Harris herself went quiet on the whole plan in the homestretch of the campaign. But the mere suggestion of a tax on their hoards of wealth drove many more of them into a frenzy.

The outrageous unfairness of all this is practically beyond description. A just tax is imposed according to one’s ability to pay, so the rich pay more. For ordinary income, that is indeed the case. But the people with the greatest possible ability to pay—people with resources exceeding entire countries—react with snarling outrage at the prospect of paying anything at all.

ProPublica illustrated the billionaire tax-avoidance machine with the leaked tax returns of several top billionaires some years ago. Counting wealth increases as income, Musk paid the most at 3.27 percent between 2014 and 2018, while Warren Buffett paid the least at just 0.1 percent. In one year, Jeff Bezos made so little traditional income that he claimed and received the Child Tax Credit, which at the time phased out at a household income over $150,000. So much for means-testing!

One couldn’t ask for greater proof of the extreme danger of hyperconcentrated wealth. When the Citizens United decision, which scrapped most controls on political spending, came down in 2010, many worried it would lead to greater influence of money in politics. But the idea that within 15 years a handful of ultra-rich people would buy an election outright, and the richest one of all would seize direct personal control of the entire federal bureaucracy, would have seemed like ridiculous hyperbole to all but a few.

Yet that is exactly what happened. One megalomaniac billionaire is leveraging his extreme wealth to tear the American system of government to shreds. Every American is under dire threat—to our freedom, our health care, our economic security, our basic way of life. That includes no small risk to billionaires themselves. American capitalism depends utterly on the foundation of federal laws and regulations—there is no such thing as “ownership” without the rule of law, as some Russian oligarchs have learned at the cost of their fortunes or their lives.

And there is no greater threat to America over the long term than climate change. Under Biden, America was for the first time doing its part to combat the threat posed by warming temperatures, which can be seen in a weekly catalog of devastating weather disasters around the country. Now one billionaire, who previously posed as a great climate hero, is doing all in his considerable power to increase emissions and strangle the development of renewable energy.

That in turn underscores the need for confiscatory taxation of extreme wealth. Allowing anyone to possess that much money is an existential danger to American democracy and society. It simultaneously drives them mad with power and gives them the resources to destroy us all, including themselves.

Ryan Cooper

Ryan Cooper is the Prospect’s managing editor, and author of ‘How Are You Going to Pay for That?: Smart Answers to the Dumbest Question in Politics.’ He was previously a national correspondent for The Week.